MKT-306 Apple’s Marketing Strategy

1. Introduction

The report aims to investigate the marketing strategy used by Apple Inc. for the latest addition of its mobile handsets, the iPhone 5 and 5s, which it directly challenges it most competitive rival with the Samsung Galaxy S3 and S4 and with other Smartphone manufacturers. In the report at first, the current market and competitive environment will be investigated and analysed, followed by identification of its competitive edges and recommendations on marketing strategies in segmentation, targeting, positioning and marketing mix activities. The core aim is to critically evaluate the best possible strategies for Apple in the mobile phone industry for present and in the future.

1.1 Background to Apple Inc.:

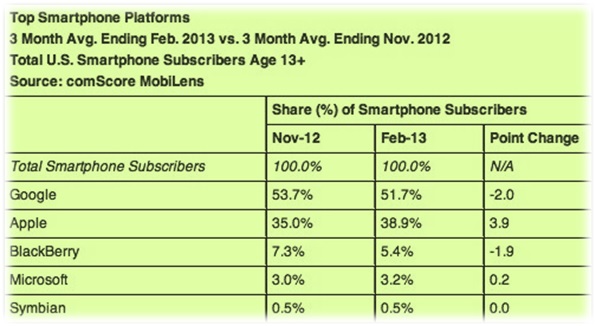

Apple Inc., formerly Apple Computer, Inc., is a multinational corporation that creates consumer electronics, computer software, and commercial servers and is best-known for Macintosh computers, the iPod, the iPhone and the iPad. For the reasons as various as its philosophy of comprehensive aesthetic design to its distinctive advertising campaign, Apple has established a unique reputation in the consumer electronics industry (Data Monitor, 2013). It has been the world’s most valuable firm since the end of last year with value of $664.74 billion and approximately 17,787 employees (Apple, 2013). Fortune magazine named ‘Apple’ the world’s most admired company in 2013 and in 2008, 2009 and 2010 respectively (CNNMoney, 2013). It is also ranked number two biggest Smartphone Company in the USA in terms of market share value 38.9% (Engadget, 2013: Figure 1) and 16.9% globally (IDC, 2013: Figure 3).

Figure 1: Smartphone Market Share in the US (Engadget, 2013).

Customers’ segmentations

According to Marketing Line (2013) report Apple’s key customers’ segmentations are:

Demographics: Male and female, teenagers and students, business people and Adults, elderly people, low to high income individuals.

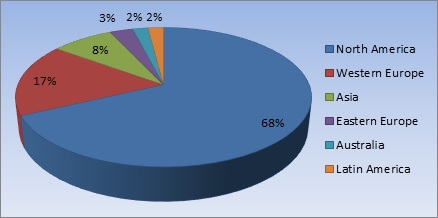

Geographic: All over the world but majority are in the North America and Western Europe (Guardian, 2013: Figure 2).

Behavioural: Individual interests in extreme innovative and differentiate electronic products and hard-core loyal.

Psychographic: Sophisticated people with high self-esteem.

Figure 2: iPhone Subscribers by region, 2012 (Guardian, 2013).

2. Situational Analysis

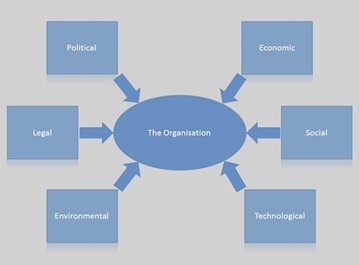

Current situational analysis of Apple should be analysed based on some tools such as SWOT analysis and Competitive analysis in reflection of PESTEL analysis and Porter’s 5 forces analysis of external environment. Please see Appendix 2 and 3.

2.1 SWOT Analysis

The SWOT analysis is a beneficial tool for decision- making and understanding dependencies between a company and its environment. Proactive thinking is enabled, rather than counting on subjective opinions (Monczka, 2010). It refers to strengths, weaknesses, opportunities and threats (Marquis and Huston, 2009). Please see Appendix 1.

Strengths:

- Apple is worldwide: it has 381 retail stores, 17,787 employees across the four continents (Apple, 2013).

- The Smartphone industry in the United States is close to being Google/Apple’s duopoly. Apple maintains 38.9% market share in the US and is able to establish globally recognised brand. Apple celebrates being world’s ‘most admired’ company in the world in 2013. It has achieved massive bargaining power (International Business Times, 2013).

- iPhone sales of 2012 were $25.2 billion which a 93% sales growth from the year is before (Apple, 2013).

- Large amount of investment have been put into increasing of cash and cash equivalent worth $51,011 million in 2012 which is 50% growth compared to 2006 (BBC, 2013).

- Good innovation and product development. It continually works towards keeping existing customers in and new customers towards the business (Guardian, 2013).

- Aesthetic design to special advertising campaign, Apple has established an exclusive unique reputation in the electronics industry (IDC, 2013).

- Integration strategy across devices: iPhone, iPads, iPods and Mac enhance customer loyalty and provide lock-in (Data Monitor, 2013).

|

Vendor |

2Q12 Unit Shipments |

2Q12 Market Share |

2Q11 Unit Shipments |

2Q11 Market Share |

Year-over-year Change |

|

Samsung |

50.2 |

32.6% |

18.4 |

17.0% |

172.8% |

|

Apple |

26.0 |

16.9% |

20.4 |

18.8% |

27.5% |

|

Nokia |

10.2 |

6.6% |

16.7 |

15.4% |

-38.9% |

|

HTC |

8.8 |

5.7% |

11.6 |

10.7% |

-24.1% |

|

ZTE |

8.0 |

5.2% |

2.0 |

1.8% |

300.0% |

|

Others |

50.7 |

32.9% |

39.2 |

36.2% |

29.3% |

|

Total |

153.9 |

100.0% |

108.3 |

100.0% |

42.1% |

Figure 3: Market growth for Smartphone globally, 2011-12: Shipments and Market share (IDC, 2013).

Weakness:

- Approximately 68% of total revenues accounted from US and Canada in 2012. Densely relying on one geographic area increase company’s exposure to local factors such as adverse economic situation, labour strikes and changes in regulations that can affect its operation (Mail Online, 2013).

- Other than geographic concentration, Apple is excessively dependant on few distributors. Consequently it may increase the risk of disruption in the company’s supply and distribution network (MarketLine, 2013).

- Apple has been involved in patent infringement. For instance, the company has lost a series of lawsuits against Samsung based on the design of their tablets and iPhone 3GS. These include cases in the Netherlands, Australia and US - despite sometimes winning temporary sales bans (The Verge, 2013).

- The company’s products and services experience quality problems from time to time. For example in 2010, it was forced to recall newly launched iPhone 4 for antenna issue and iPod nano with faulty screen (Data Monitor, 2013).

- Apple’s success and Steves Jobs’ leadership were tied up so strongly. Apple’s stock has been in decline in 2012 from $700 to $400 after he died, causing many analysts to speculate: is Apple’s reign coming to an end? (Market line, 2013)

Opportunity:

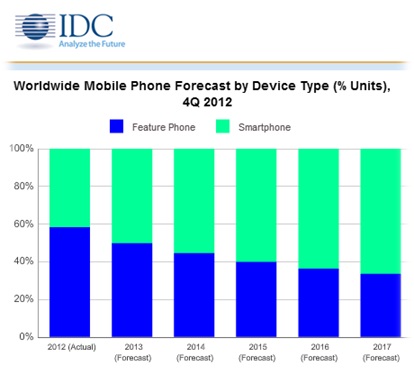

- International expansion into emerging markets of China and India. This may offer a lot of business due to the dense population. Also, IDC (2013: Figure 4) inspires it to go global as Smartphone industry is growing fast and Apple secures second position on the table.

- Apple could use CRM, database marketing to more accurately market to its consumer target groups. It could identify customers (based on modeling and profiles of shoppers) and prevent brand switching (Engadget, 2013).

- Apple may have joint ventures with retailers (e.g. mobile phone retailers). Possible move could be an option of combo deal of iPhone and other products (BBC, 2013).

- Apple needs to rebuild its gravity on legal issues on patent infringement and put control over the quality check (The Verge, 2013).

- Apple should concentrate more on competitive as competitors are offering similar devices for lower prices. Also it should consider different product lines for various segmentations (Foster, 2012).

- Apple has opportunity to improve on customer satisfaction over the products and involvement on Corporate Social Responsibility (CSR) and charitable events (Engadget, 2013).

- In the next 5 years the UK’s population is forecasted to be over 65 million and GDP growth is expected to increase in 2013, to 1.7% which is good news for both the mobile phone networks and mobile handset manufacturers (Keynotes, 2013).

Figure 4: IDC’s 2013 worldwide Smartphone sales predictions (IDC, 2013).

Threats:

- Apple faces threat from other major Smartphone manufacturers such Google and Blackberry. Google produced the highest percentage sales among the three which is a threat for Apple. The cost to produce the devices during inflation and lack of sales puts Apple in a tough spot and other competitors could take advantage to advertise new product and hence raising their sales (Chiffin, 2012).

- Apple also competes with number of well-capitalized national and international manufacturers such as Nokia, HTC and ZTE and so on. It also competes with regional manufacturer, such as ZTE’s Grand series (ComScore, 2013).

- Competitive pressure on the high street as other new entrants offering value and greater product ranges with lower prices e.g. Nokia Lumia series and HTC desire series (CNNMoney, 2013).

- Samsung, the closest competitor, has been offering the Galaxy S3 with a bigger screen, longer battery lifespan and with extra features like NFC (Near Field Communication) capabilities and removable battery (Marketing magazine, 2013).

- Like all other industry, the mobile phone industry is continuously threatened by slow economy recovery. The economic downturn four years ago still hinders financial strength of North America and European countries where Apple holds 85% of its market share (CNN, 2013).

2.2 Differential Advantage/ Competitive Edge

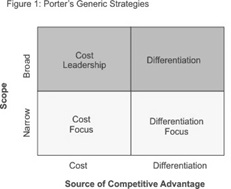

Evans (2012) states, Competitive advantage is achieved whenever you do something better than competition. Competitive edge should support organisational strategy and reflect key market capabilities (Papp, 2001). Porter goes on to suggest in his work that competitive advantage ‘grows out of the value a firm is able to create for its buyers that exceeds the firms cost of creating it (Poter, 1988).

2.2.1 Competitive Analysis

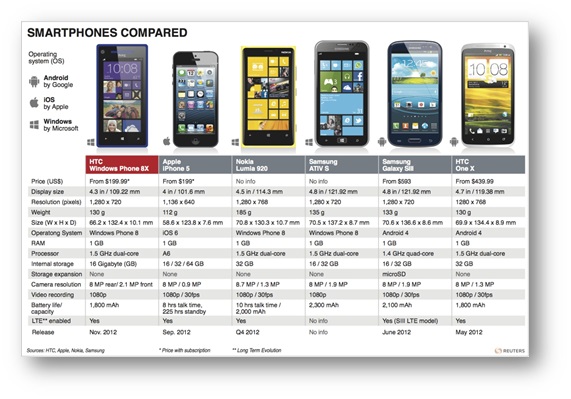

Following is a summary of the key competitors’’ activities from the IDC (2013) research. Please see Appendix 3 and 4.

SAMSUNG

Electronics Company, Samsung, has a diverse number of businesses but is best known to the public for its Mobile, TV, Camera and home appliance products, accounts 32.6% global market share. The key products to compete with iPhones are the Smartphones (Galaxy SIII, Galaxy SII). However, it relies on Android Apps stores. The North Korean based company sponsors Chelsea Football Club in the UK to advertise its brand in and out of the ground (Marketing week, 2013). Online media such as Face book, YouTube and Twitter are also used as communication platform to sustain the marketing campaigns (Samsung, 2013).

NOKIA

Finnish telecoms company Nokia, is led by CEO Stephen Elop, a former Microsoft executive. It is the biggest handset manufacturer globally but in Western Europe has been outflanked by rivals, including Apple, in the smart phone sector. Its latest initiative is in the field of contactless payment technology via its C7 handset. (Marketing week, 2013). Despite of having higher sales of its Lumia smart phones, have fallen 13% of its market share in the first quarter 2013. It is trying to compete on the segment where consumers are moving from feature phones to smart phones, but they want cheap smart phones. It has also introduced latest Lumia, which can be used with gloves, more convenient to use in the winter (BBC, 2013). Range of product competes with iPhone devices are: Lumia 720, 920, 820, 620, 520, 900, 800, 610, and 510 (Nokia, 2013).

HTC

HTC is familiar as a designer and manufacturer of many of the most popular OEM-branded mobile devices on the market and it secures 5.7% global market share. ‘HTC First’ is known as first real ‘Face book phone’ and it’s a Smartphone powered by the Android and Windows phone operating systems. HTC One, HTC First, HTC One SV and HTC One Desire C are the key competitors of iPhones. Lately HTC arranged a global TV campaign which features a skydiving photo shoot on an HTC one camera (HTC, 2013).

ZTE

Chinese mobile manufacturer ZTE, the world’s fourth biggest handset maker by volume with 5.2% global market share, is preparing a major push to grab a slice of the UK market by positioning as an ‘’underground’’ and ‘’cool’’ brand that opens up the mobile internet to all. Its co-partners are Orange, T-Mobile and Vodafone in the UK for its network devices such as Rio, San Francisco and Sydney from Orange, T-Mobile Affinity, T-Mobile Vairy Touch II and T-Mobile Vivacity and Vodafone 351. ZTE Grand series are the competitors to iPhones (ZTE, 2013).

2.2.2 Competitive Edges

Apple’s horizontal integration strategy across devices and channels and vertical integration strategy from chip design to software and retail creates a truly sustainable competitive advantage that is hard to replicate by the competitors. For that reason alone its valuation skyrocketed worth of $400 billion (the guardian, 2013). This is brilliant example of classic business strategy theory at work. Apple products are also highly innovative and differentiated which creates a cutting edge as the pioneer in the market. For instance, forbes.com (2013) state, Apple has been ranked number 1 as most innovative company since 2005 by more than 1,500 senior executives in a wide range of countries.

There is an interesting ‘Apple Math’: iPhone+ iPad+ iPod+ Mac= Market Dominance. Every single Apple products complement (compete) and complete each other. For instance, get an iPad, and you can download content via iTunes and access them through iCloud and use that to move content to iPad or other devices. The sort of control over the entire user experience or process, from hardware to software, strengthens customer loyalty and provides lock-in. You cannot leave Apple once you are in. It is becoming the consumer equivalent of IBM for business (International Business Time, 2013).

3. Recommendations

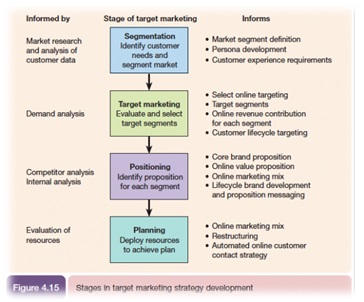

3.1 Segmentation, Targeting & Positioning

In the real world of building products and attacking market opportunities, market segmentation is the process of defining and sub-dividing the aggregate, homogeneous market into addressable, targeted needs and aspirations buckets. Buckets those are in turn, threshold by demographic, psychographic and/or budgetary constraints (Moyano, 2011). Please see Appendix 5.

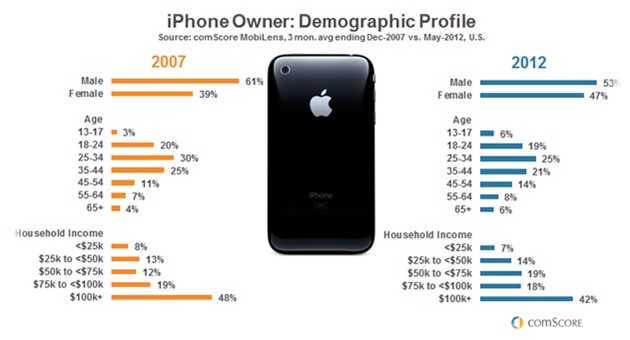

Being consistent with the Apple’s segmentation, Apple’s Smartphone should target to more psychographic segmentation, which appeals to consumers’ personalities, attitudes, motives, and lifestyles. According to comScore (2013), being a "lifestyle brand" and this lifestyle appeals to Tweens to Boomers, low-income to high-income individuals, and all shape, race, and size are captured. Apple has a branding strategy that focuses on the emotions. The Apple brand personality is about lifestyle; imagination; liberty regained; innovation; passion; hopes, dreams and aspirations; and power-to-the-people through technology. The Apple brand personality is also about simplicity and the removal of complexity from people's lives; people-driven product design; and about being a really humanistic company with a heartfelt connection with its customers.

Figure 5: iPhone’s segmentation targeting (comScore, 2013).

According to Porter (1988), organisations have the choice of the following competitive positions: cost leadership, differentiation, cost focus and differentiation focus (Please see Appendix 6). Apple has used a concentrated targeting strategy that has helped its position themselves as a niche and best quality and differentiated product for premium pricing. A limited product mix and small product lines have also worked to their benefit, which many might say goes against convention. And now this "niche" brand appeals to the masses.

3.2 Marketing objectives and goals

Apple’s marketing goals and objectives (Appendix. 7) should be consistent to ensure its products uniqueness and exclusiveness. The marketing objectives for Apple on Smartphone devices should sustain its previous objective ‘’ how technology will make your life better’’. It should continue to bring the latest innovative and developing standardised devices to the consumers (Pride and Ferrel, 2012).

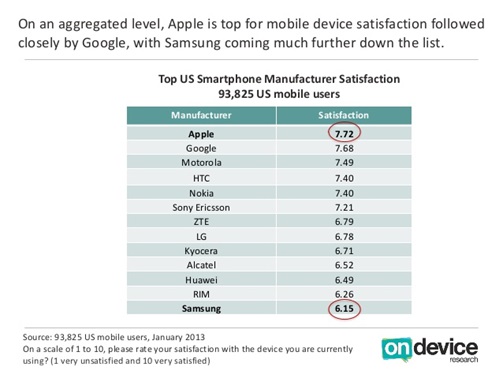

With regard to communications objectives, Apple should higher customer satisfaction level (Figure 6) from 7.72 to 8.00 in year 1 and 8.00 to 8.5, and 8.5 to 9.00 in rating in year 2 and 3 respectively. Apple should develop strategies for serving their chosen customers better than competition.

Figure 6: US Smartphone manufacturer satisfaction survey (ondevicereseach, 2013).

Marketing Goals: According to Engadget (2013, Figure: 1), Apple has market share of 38.9% in the US Smartphone market. On the next 18 months it should set a target of increasing further 5% and 2% global share growth over the new launches like iPhone 5s and so on.

However, marketing has a negative effect on society and how an organisation interacts called Social Corporate Responsibility (CSR). Apple should take responsibility for the effect of its actions and the consequences of these actions on its consumers, communities, customers, employees, and so on. ‘The Body Shop’ regularly funds and supports wider ethical and charitable events (Body shop, 2013).

Despite of donation worth of $50 million to Stanford University hospitals and another $50 million to African aid organisation that has not developed a reputation for philanthropy whereas Exxon, Apple’s closest rival for the top slot, was named one of the top ten ‘’most charitable companies in America’’ and donated $198,692,197 in 2010. Therefore Apple should participate on more charity events which not only help the poor but help to enhance brand image (Huffingtonpost, 2013).

3.3 Marketing strategies and programmes

Marketing strategies in terms of marketing mix refers to a unique blend of product, place (distribution), promotion and pricing strategies (often referred to as the 4P’s) designed to produce mutually satisfying exchanges with a target market (Notedesk, 2013: Appendix 8).

3.3.1 Product

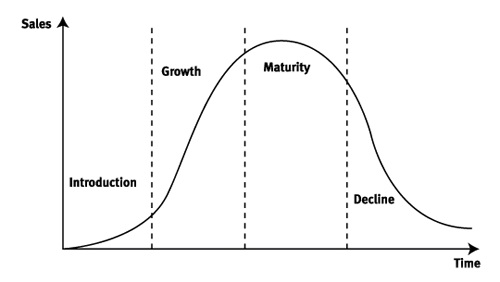

Guardian research (Figure: 2) shows Apple is not well globalised company. It has good opportunity to more international expansion especially in BRIC countries (Brazil, Russia, India and China). GDP growth and densely population should offer a lot to the business. Apple is suggested to consider these market for iPhone 4 and 4s on their ‘maturity stage’ (Figure: 7) with penetration pricing in order to improve its global market share (16.9%, Figure: 3).

In addition to it, Apple could offer new product line extensions to consumer for iPhone 5 and 5s and future devices for the following types of customer segmentation as ‘product life cycle’ develop.

Figure 7: Classic product life cycle, (Kaplan, 2013).

- Teenagers and Students: This range will target the teenagers as they use iPhones to socialise with friends, listen to music and go on Facebook, MSN and Twitter and the students take quick record notes. Therefore it should add more social network apps and useful apps for students. For instance, Instagram Apps (CNN, 2013).

- Business People: This category of iPhone should have a business quality to finish work efficiently even on the move. For example: easy communication facilities with the clients or an appointment management system. In addition, sending documents is easy and organised.

- Adults: This type of iPhone should focus on everyday needs such as phone calls, map directions, internet connection, documents and cameras. It is important to make sure these small devices make adults lives much easier for communication daily.

- Retirees: Apple can offer basic iPhone to make phone calls easier for people unfamiliar with modern technology or with bad eyesight. It should therefore design with clearly labelled buttons and few numbers could be programmed into the phone so they can make calls with a touch. Cycell has brought special phones for elderly people through the Age UK Shop, are very successful (Mail online, 2013).

- International: This classification would target the massive international market all over the Asia, Africa, some parts of Europe poor and developing countries. GDP growth and purchasing power of those countries may not allow Apple to consider price skimming strategy however the company can consider penetration pricing. This intensive market coverage may lead the company to increase its level of production. More likely, it should be great number of shipments would lower the production costs prices to the final consumers.

More importantly Apple needs to deal with complaints of severe battery drainage for iPhone, iPod, iPad on iOS 6.1.3 version. Other than this, Black and White do not give enough colour choices to the consumers (CNN, 2013).

3.3.2 Pricing

As mentioned above, iPhone devices consist of five product lines for the different segments of customers. Basically, Teenagers and Student, Business People and Adults target to the more demanding customers in terms of best quality, innovative and aesthetic design. Therefore, skimming pricing should be used to increase its perceived value.

As for the Retirees and International range, the devices include are mostly targeting to a wider salary and age range of people. Therefore, penetration strategy is suggested to be used. Moreover, this range of devices has a lower price hurdle and higher value for money. As such, the ranges serve as entry-level products to encourage the customers to firstly try and experience the value for money products, as such to trade up the customers to buy other more products (iPads, iPods and Mac). However, Apple is suggested to adopt ‘Dynamic Accounting’ concept where it should put every effort to reduce production costs in order to offer more competitive price (Pride and Ferrel, 2012).

3.3.3 Promotion

Strategy: A pull strategy is suggested to stimulate its consumers so that they request the product from Apple or intermediaries and ‘pull’ the device from the distribution channel. Apple needs to use different types of promotional activities to create awareness and interest about its products Appendix 9-10(d).

Above-the-line Activities

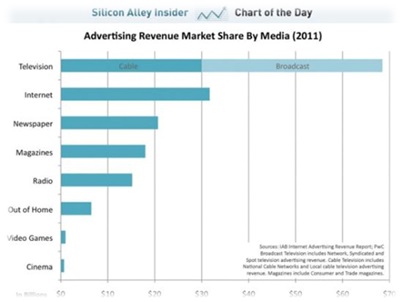

Media Implementation

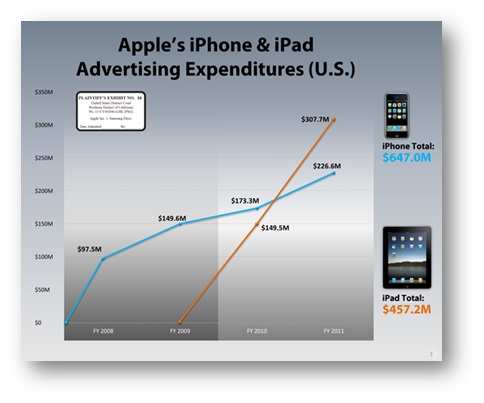

Figure 8 shows the distribution of current advertising spending on different media. The budget on iPhone has been always uprising since 2009, so the company is suggested that the Apple spend the media budget in various advertising media such as: TV, Radio, Campaign, Newspapers, Press, Magazines, Journals and Internet, Social networks, Third party websites, Cinema, and so on.

For the internet media, basically the company should build up its own online social networking media (e.g. Face book, Twitter and YouTube) to promote the products and also allow co-creation of message with the participants.

It is also suggested that the company should sponsor some events or games. For instance, Emirates Airlines sponsors Arsenal Football Club. Also it can fund to the charities regularly like British Heart Foundation or show real commitment to the social corporate responsibility. It will enhance the brand image and brand equity eventually.

Figure 8: Monitored advertising expenditure in different media in the US on iPhone and iPad, 2008-11 (The Verge, 2013).

Below-the line promotion

In-store and distributors promotion

As mentioned above, Apple should conduct regularly with intermediaries promotions to cover the message not only Smartphone but also iPods and iPad, and Mac for a combined deal.

3.3.4 Place

Since Apple has consumers all over the world, iPhone Smartphone can preferably sold on its own website. The devices can be delivered for free and swiftly as customer satisfaction, is very crucial. Moreover, the company should consider ‘intensive’ market coverage and that is why it should build more i-stores in major cities and towns or purchase retail outlets in order to control the distribution channels.

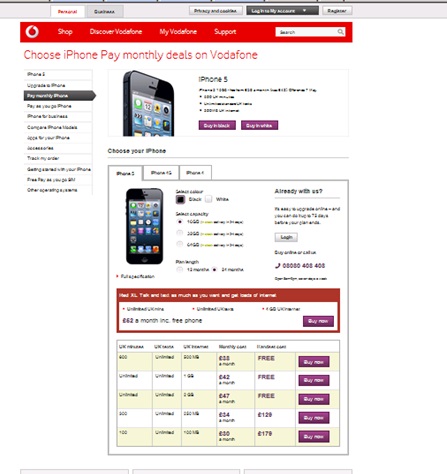

Before that Apple may co-operate with the telecommunication service providers and use their networks to sell the products. However, too many intermediaries in the distribution channels may lead the company to lose the control. It is advised that Apple bind the distributors with legal contract to deal with the issues such as stock levels, levels of after sales services and territories. It also can set specific and realistic agreed targets for the distributors to assess their performance.

4. Conclusions

In this case, Apple’s Smartphone iPhone is chosen. Based on above analysis, it is recommended that Apple should focus on launching various categories of iPhones: Teenagers and students, Business people, Adults and Retirees and international segments of customers who concerns about modern, possible best quality and pioneer innovation on devices with their own different needs and affordability’s.

With the revamped product lines, the key marketing objective is to build up the brand awareness, attitude and recognition among the target customers, which are more skewed toward the male and female, young children and kids, students, adults, entrepreneurs, elderly people, international and low to high income individuals.

Finally, the marketing mix strategy is presented to illustrate what 4P (product, place, promotion, and price) activities are planned to achieve the marketing objectives.

References

Apple (2013) Investor relations: Financial History, Annual Report 2011-12. Available at http://investor.apple.com/financials.cfm (Viewed on: 21 April 2013).

BBC (2013) News technology: Apple loses UK tablet design appeal versus Samsung. Available at: http://www.bbc.co.uk/news/technology-19989750 (Viewed: 18 April 2013)

BBC (2013) Business:Nokia shares fall despite Lumia higher sales. Available at: http://www.bbc.co.uk/news/business-22197404 (Accessed on: 20 April 2013).

Body Shop (2013) The body shop foundation: what we do. Available at: http://thebodyshopfoundation.org/what-we-do/faqs/ (Viewed on: 26 April 2013).

Chaffin, B. (2012), the Mac observer: Apple’s iphone takes smartphone share from Android in US. Available at: http://www.macobserver.com/tmo/article/apples_iphone_takes_smartphone_share_from_android_in_u.s (Accessed on: 19 April, 2013).

CNN.com (2013), Apple’s three biggest weaknesses. Available at: http://edition.cnn.com/2011/TECH/innovation/04/07/apple.weakness/index.html?iref=allsearch (Viewed on: 08 May 2013).

CNNMoney (2013), Fortune: World’s Most Admired Companies. Available at: http://money.cnn.com/magazines/fortune/most-admired/ (Viewed on: 08 May 2013).

ComScore.com (2013), ComScore reports March 2013 U.S Smartphone subscriber market share. Available at: http://www.comscore.com/Insights/Press_Releases/2013/5/comScore_Reports_March_2013_U.S._Smartphone_Subscriber_Market_Share (Accessed on: 08 May 2013).

DataMonitor (2013) Company profile: Apple Inc. Available at: http://ehis.ebscohost.com/eds/pdfviewer/pdfviewer?vid=2&sid=9231f36b-97d3-466b-8eff-183a43b17574%40sessionmgr112&hid=109 (Viewed on: 21 April 2013).

Engadget (2013) Strategy Analytics: Android claimed 70 percent of world smartphone share in Q4 2012. Available at: http://www.engadget.com/2013/01/29/strategy-analytics-android-70-percent-share/ (Accessed on: 19 April 2013)

Forbes.com (2013), Apple #1, Google #2 - 50 Innovative Companies Ranked By1, 500 Execs. Available at: http://www.forbes.com/sites/tjmccue/2013/01/10/apple-1-google-2/ (Viewed on: 08 May 2013).

Foster, B. (2012) Blog: Smartphone operating system: Global Market Share. Available at: http://www.sharewales.com/index.php/phone-wars-when-brand-recognition-is-not-enough/smartphone-share-2/ (Accessed on: 20 April 2013).

Guardian (2012) Technology blog: Android tightens grip on Smartphone market in second quarter of 2012. Available at: http://www.guardian.co.uk/technology/blog/2012/aug/10/android-smartphone-market-2012-apple (Accessed on: 20 April 2013).

HTC (2013) Products:Smartphones. Available at: http://www.htc.com/uk/smartphones/ (Viewed on: 05 May 2013).

Huffintonpost (2013), Live:Apple’s Donations to Charity Surpassed $50 Million: Report. Available at: http://www.huffingtonpost.com/2012/02/03/apple-charity-donation_n_1253185.html (Viewed on 08 May 2013).

IDC (2013) IDC- Press release:Smartphone expected to out ship feature phones for first time in 2013. Available at: http://www.idc.com/getdoc.jsp?containerId=prUS23982813 (Accessed on: 20 April 2013).

International Business Times (2013) Companies:Apple’s competitive advantage: Multiple products that integrates. Available at: http://www.ibtimes.com/apples-competitive-advantage-multiple-products-integrate-one-300605 (Accessed on: 21 April 2013).

Kaplan (2013) Kaplan Financial Knowledge Bank: Corporate Failure. Available at: http://kfknowledgebank.kaplan.co.uk/KFKB/Wiki%20Pages/Corporate%20Failure.aspx (View on: 28 April 2013)

Keynote (2013), Market report: telecommunication: Mobile Phones Market report 2012. Available at: http://www.keynote.co.uk/market-intelligence/view/product/10570/mobile-phones?utm_source=kn.reports.browse (Accessed on: 08 May 2013).

Mail Online (2013) Science: The 'MyPhone': Age UK launch 'no frills' £55 mobile phone to make calls on the go easier for elderly just in time for Christmas. Available at: http://www.dailymail.co.uk/sciencetech/article-2228910/Age-UK-launch-frills-mobile-phone-elderly.html (Viewed on: 28 April 2013)

MarketLine (2013) Company profile: Apple Inc. Available at: http://ehis.ebscohost.com/eds/pdfviewer/pdfviewer?vid=2&sid=cfddf533-dcda-49ef-b55b-d581977aa1ff%40sessionmgr115&hid=109 (Viewed on: 21 April 2013).

Marketingmagazine (2013) Marketing, News: Facebook eyes expansion of home to Apple and Microsoft phones. Available at: http://www.marketingmagazine.co.uk/news/1178460/Facebook-eyes-expansion-Home-Apple-Microsoft-phones/?DCMP=ILC-SEARCH (Viewed on: 21 April 2013).

Marketingweek (2013) Brands: Samsung. Available at: http://www.marketingweek.co.uk/brands/samsung/ (Accessed on: 20 April 2013).

Marketingweek (2013) Brands: Nokia. Available at: http://www.marketingweek.co.uk/brands/nokia/ (Accessed on: 20 April 2013).

Marquis, B. and Huston, C. (2009) Leadership Roles and Management Functions in Nursing: Theory and Application. Sixth edn. USA: Lippincott William & Wilkins.

Monczka, R. (2010) Purchasing and Supply Chain Management. Fifth edn. UK: Cengage Learning EMEA.

Moyano, R (2011) Apple Blog.R:Segmenting and Targeting Markets. Available at: http://appleblogr.blogspot.co.uk/2011/05/ch-8-segmenting-and-targeting-markets.html (Viewed on: 25April 2013).

Nokia (2013) Phones: Lumia Phones. Available at: http://www.nokia.com/gb-en/phones/lumia/ (Accessed on: 05 May 2013).

Notesdesk (2013), Marketing mix: 4P’s of marketing. Available at: http://notesdesk.com/notes/marketing/the-marketing-mix-4-ps-of-marketing (Viewed on 04 May 2013).

Pride, W. and Ferrel, O., (2012) Marketing. Sixteen edn. USA: South- Western Cengage Learning.

Porter, M. (1988) Competitive Advantage: creating and substaining superior performance. Second edn. USA: The Free Press.

Samsung (2013) what we make. Available at: http://www.samsung.com/uk/#latest-home (Accessed on: 20 April 2013).

The Verge (2013) Mobile: Schiller, Forstall, and Fight club’: day three of Apple v. Samsung. Available at: http://www.theverge.com/2012/8/3/3218846/schiller-forstall-fight-club-day-three-apple-samsung-trial (Viewed on: 27 April 2013).

ZTE (2013) Product: Smartphones. Available at: http://www.ztedevices.com/product/smart_phone/index_1.html (Accessed on: 05 May 2013).

Bibliography

Armstrong, G., Kotler, P., and Brennan, R. (2009) Marketing: An Introduction. UK: Pearson Education Limited.

Burrow, J. (2009) Marketing. Third edn. USA: South-Western Cengage Learning.

David, A. (2001) Strategic Market Management. Sixth edn. New York: John Wiley & Sons, Ltd.

David, J. (2004) Principles and Practice of Marketing. Fourth edn. McGraw-Hill International (UK) Ltd.

Doole, I. and Lowe, R. (2008) International Marketing Strategy. Fifth edn. USA: South- Western Cengage Learning.

Fifield, P. (2012) Marketing Strategy. Second edn. Oxford: Butterworth-Heinemann.

Jim, B. (2001) Essential marketing. Second edn. UK: Pearson Education Limited.

Jobber, D. (2010) Principle and Practice of Marketing. Sixth edn. UK: McGraw-Hill Education.

Jobber, D., and Fahy, J. (2009) Foundations of Marketing. Third edn. UK: McGraw-Hill Education.

Kotler, P. and Armstrong, G. (2010) Principles of Marketing. Thirteen edn. USA: Pearson Education Inc.

Kotler, P. et al (2012) Marketing Management. Second edn. UK: Pearson Education Limited.

Miachel, B. (2007) Marketing strategy and management. Fourth edn. Basingstoke: Palgrave Macmillan.

Peter, D. and Philip, S. (2006) Marketing management and strategy. Fourth edn. UK: Pearson Education Limited.

Sandhusen, R. (2008) Marketing. Fourth edn. USA: Barron’s educational Series, Inc.

Shankar, V. and Carpenter, G. (2012) Handbook of Marketing Strategy. UK: Edward Elgar Publishing Limited.

Svend, H. (2010) Marketing Management: A relationship Approach. Second edn. UK: Pearson Education Limited.

Appendix

Appendix 1

Figure1: SWOT Analysis

Easy-Marketing-Strategies.com (2013) How to do a SWOT analysis, Available at: http://www.easy-marketing-strategies.com/swot-analysis.html (viewed on 06 May 2013)

Appendix 2

Figure 2: Environmental PESTEL Analysis

Professional Academy: Marketing Theories- PESTEL Analysis (2012). Available at: http://www.professionalacademy.com/news/marketing-theories-pestel-analysis (Viewed: 01 May 2013).

Appendix 3

Figure 3: The Five Competitive Forces That Shape Strategy.

Harvard Business Review: The Five Competitive Forces That Shape Strategy. Available at: http://hbr.org/2008/01/the-five-competitive-forces-that-shape-strategy/ar/1 (Accessed: 04 December 2012).

Appendix 4

Figure 4: Competitive analysis of Apple (iPhone 5)

Thomsonreuters.com (2013), Smartphones compare- graphic of the day, Available at: http://blog.thomsonreuters.com/index.php/tag/iphone-5/ (Viewed on 04 May 2013)

Appendix 5

Figure 5: Stages in target marketing strategy development.

PBT Consulting (2013), Strategic planning, business planning and venture capital, Available at: http://tommytoy.typepad.com/tommy-toy-pbt-consultin/2012/02/a-marketing-plan-should-be-a-written-document-not-scratchings-on-a-cocktail-napkin-or-recalled-from-memory-to-take-your-bus.html (Viewed on 04 May 2013).

Appendix 6

Mind Tools Essentials for an excellent career, Porter's Generic Strategies Choosing Your Route to Competitive Advantage (2013) viewed 08 May 2013, http://www.mindtools.com/pages/article/newSTR_82.htm

Appendix 7

Figure 7: Strategic goals and objectives (SMART Analysis).

Learnmarketing.net, SMART objectives analysis, 2013, viewed 6th May 2013, http://www.learnmarketing.net/smart.htm

Appendix 8

Figure 8: Marketing mix (4P’s)

Notesdesk (2013), Marketing mix: 4P’s of marketing, Available at: http://notesdesk.com/notes/marketing/the-marketing-mix-4-ps-of-marketing/ (Viewed on 04 May 2013).

Appendix 9

Figure 9: Adverting share of US media in 2011.

Venturedataorg.com (2013), Internet news: The report shows that U.S. internet advertising revenue over cable TV ads, Available at: http://www.venturedata.org/?i442148_The-report-shows-that-U.S.-Internet-advertising-revenue-over-cable-TV-ads (Accessed on 04 May 2013).

Appendix 10: Apple’s online website Design: Main page

Apple (2013), iPhone, Available at: http://www.apple.com/iphone/ (Accessed on 04 May 2013).

Appendix 10 (a): Apple Communication Campaign in the ‘Underground’.

Figure 10 (a): Apple’s (iPhone 5) promotional activities.

BBC (2013), dot. Life: iPhone price cut – weakness or strength? , Available at: http://www.bbc.co.uk/blogs/technology/2008/04/iphone_price_cut_weakness_or_s.html (Accessed on 06 May 2013).

Appendix 10(b): Apple’s iPhone communication Campaign on ‘Hublot’, T-Mobile and Vodafone Websites.

Bgr.com (2013), Apple reportedly ‘caught flat-footed’ by the rise of phablets, Available at: http://bgr.com/2013/04/23/iphone-5-sales-analysis-459247/ (Accessed on 04 May 2013).

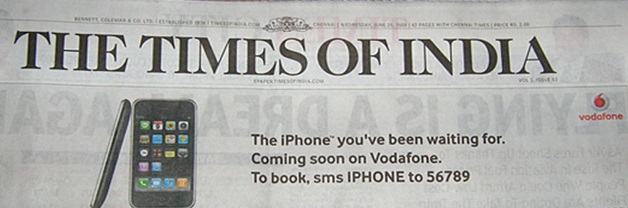

Appendix 10 (c): Print Ad of Apple Communication Campaign

Ilounge.com (2013), Global iPhone 5 promotions begins, Available at: http://www.ilounge.com/index.php/news/comments/global-iphone-3g-promotions-begin/ (Accessed on: 04 May 2013).

Appendix 10 (d): In-store poster of Apple Communication Campaign

Digital spy (2013), Tech Apple: Apple’s iPhone reaches its fifth birthday – pictures, Available at: http://www.digitalspy.co.uk/tech/i416162-8/the-history-of-the-iphone-in-pictures-app-store-poster.html (Viewed on: 04 May 2013)

Resources

- 24 x 7 Availability.

- Trained and Certified Experts.

- Deadline Guaranteed.

- Plagiarism Free.

- Privacy Guaranteed.

- Free download.

- Online help for all project.

- Homework Help Services