FIN4320 Exam 1

Finance 4320 Exam 1

1. Johnson family has found that the current cost of attending college is $25,000 per year. How much lump sum amount they should have in their education account so that the 4 years of college is funded? Assume education inflation to be 6.25% and investment return to be 7.5% per year. BGN MODE

- $98, 269

PV = ? = $98,269.29 = $98,269

N = 4

I/Y = (1+.075)/(1+.0625) -1 = 1.1765%

PMT = $25,000

FV = 0

2. Steve is planning to retire in couple of years. He has estimated that his annual requirement at the beginningof the1st year of retirement would be $75,000 per year. He expects to live for 22 years after retirement. How much should be the accumulated (lump sum) amount in his retirement account at the beginning of retirement so that his post retirement period is funded. Assume inflation to be 2.75% and investment return to be 8.25% per year. BGN MODE

- $1,007,417

PV = ? = $1,007.417.06 = $1,007,417

N = 22

I/Y = (1.0825)/(1.0275) -1 = 5.3528%

PMT = $75,000

FV= 0

Peter who is self-employed has the following income and expenses during the year:

|

Business Income |

115,000 |

|

Interest Income |

1,500 |

|

Dividend Income |

2,200 |

|

Hobbies |

550 |

|

Recreational Expenses |

5,500 |

|

Vacation Expenses |

2,500 |

|

Alimony |

950 |

|

Healthcare Cost |

5,250 |

|

Clothing Expenses |

780 |

|

Insurance Cost |

6,250 |

|

Food Expenses |

8,275 |

|

Taxes |

1,150 |

|

Furniture Cost |

12,000 |

|

Debt Repayment |

22,000 |

|

New Debt Taken |

2,575 |

|

Retirement investments |

15,500 |

3. What is the total financing activities during the year?

- ($19,425)

New Debt Taken – Debt Repayment = Total Financing Activities

2,575 – 22,000 = -$19,425

4. What is the net cash flow during the year?

- $40,570

Total Cash Flow – Targeted for retirement = Net Cash Flow

Total Cash Flow = Cash Flow from Operating Activities – Capital Expenditure -+ Financing Activities

Cash Flow from Operating Activities = Income – Discretionary – Nondiscretionary expenses

|

Business Income |

115,000 |

|

Interest Income |

1,500 |

|

Dividend Income |

2,200 |

|

Total Income |

118,700 |

|

Hobbies |

550 |

|

Recreational Expenses |

5,500 |

|

Vacation Expenses |

2,500 |

|

Total Discretionary |

8,550 |

|

Alimony |

950 |

|

Healthcare Cost |

5,250 |

|

Clothing Expenses |

780 |

|

Insurance Cost |

6,250 |

|

Food Expenses |

8,275 |

|

Taxes |

1,150 |

|

Total Nondiscretionary |

22,655 |

Cash Flow from Operating Activities = $118,700 – $8,550 – $22,655 = $87,495

Total Cash Flow = $87,495 – $12,000 - $19,425 = $56,070

Net Cash Flow = $56,070 – $15,500 = $40,570

5. What is the total cash flow from operations during the year?

- $87,495

Cash Flow from Operating Activities = Income – Discretionary – Nondiscretionary expenses

|

Business Income |

115,000 |

|

Interest Income |

1,500 |

|

Dividend Income |

2,200 |

|

Total Income |

118,700 |

|

Hobbies |

550 |

|

Recreational Expenses |

5,500 |

|

Vacation Expenses |

2,500 |

|

Total Discretionary |

8,550 |

|

Alimony |

950 |

|

Healthcare Cost |

5,250 |

|

Clothing Expenses |

780 |

|

Insurance Cost |

6,250 |

|

Food Expenses |

8,275 |

|

Taxes |

1,150 |

|

Total Nondiscretionary |

22,655 |

Cash Flow from Operating Activities = $118,700 – $8,550 – $22,655 = $87,495

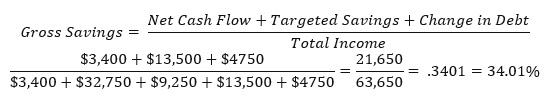

6. Consider the following statistics for a household's annual cash flow:

Net Cash Flow ($3,400); Nondiscretionary Expenses ($32,750); Discretionary Expenses ($9,250); Retirement Investments ($13,500) and Debt Repayment ($4750).

Calculate the Gross Savings percentage.

- $34.01%

7. Maria wants to accumulate $45,000 in today's dollar terms in the next 6 years. She expects to earn a return of 6.25% per year and inflation is expected to be 1.75%. How much should be the serial payment in the 5th yearso that Maria can achieve the target? END MODE

- $7321

FV = $45,000

N = 6

I/Y = (1.0625)/(1.0175) – 1= 4.4226%

PV = 0

PMT = ? = $6,712.58

Serial Payment 1 = $6,712.58*1.0175 = $6,830.05

Serial Payment 2 = $6,830.05*1.0175 = $6,949.58

Serial Payment 3 = $6,949.58*1.0175 = $7,071.19

Serial Payment 4 = $7,071.19*1.0175 = $7,194.94

Serial Payment 5 = $7,194.94*1.0175 = $7,320.85 = $7,321

Serial Payment 6 = $7,320.85*1.0175 = $7,448.96

8. Maria wants to accumulate $45,000 in today's dollar terms in the next 6 years. She expects to earn a return of 6.25% per year and inflation is expected to be 1.75%. How much should be the serial payment in the 6th yearso that Maria can achieve the target? END MODE

- $7449

FV = $45,000

N = 6

I/Y = (1.0625)/(1.0175) – 1= 4.4226%

PV = 0

PMT = ? = $6,712.58

Serial Payment 1 = $6,712.58*1.0175 = $6,830.05

Serial Payment 2 = $6,830.05*1.0175 = $6,949.58

Serial Payment 3 = $6,949.58*1.0175 = $7,071.19

Serial Payment 4 = $7,071.19*1.0175 = $7,194.94

Serial Payment 5 = $7,194.94*1.0175 = $7,320.85

Serial Payment 6 = $7,320.85*1.0175 = $7,448.96 = $7,449

9. Maria wants to accumulate $45,000 in today's dollar terms in the next 6 years. She expects to earn a return of 6.25% per year and inflation is expected to be 1.75%. How much should be the serial payment in the 2nd yearso that Maria can achieve the target? END MODE

- $6950

FV = $45,000

N = 6

I/Y = (1.0625)/(1.0175) – 1= 4.4226%

PV = 0

PMT = ? = $6,712.58

Serial Payment 1 = $6,712.58*1.0175 = $6,830.05

Serial Payment 2 = $6,830.05*1.0175 = $6,949.58 = $6,950

Serial Payment 3 = $6,949.58*1.0175 = $7,071.19

Serial Payment 4 = $7,071.19*1.0175 = $7,194.94

Serial Payment 5 = $7,194.94*1.0175 = $7,320.85

Serial Payment 6 = $7,320.85*1.0175 = $7,448.96

10. What is the difference in future value between savings in which $2,500 is deposited each year at the beginning of the period and the same amount deposited at the end of the period? Assume an interest rate of 5.75% per year and that both are due at the end of 12 years.

- $2390

END:

PV = 0

N = 12

I/Y = 5.75%

PMT = $2500

FV = ? = $41,564.37

BGN:

PV = 0

N = 12

I/Y = 5.75%

PMT = $2500

FV = ? = $43,954.32

$43,954.32 - $41,564.37 = $2,389.95 = $2,390

Dorothy has $750 in cash, $2000 in savings account, $34,300 in stocks, $5,500 in bonds, and owns a car worth $15,500. She had $1,500 in credit card payments and an education loan of $24,000 of which $2,700 is due during the current year. She has a mortgage loan of $300,000 of which $7,000 due this year. She has an auto loan of $9,500 of which $3,700 is due in the next 12 months. She owns a home worth $350,000, furniture and fixtures of $1,500, appliances with a value of $1,000, a Condo worth $120,000 and stamp collection of $1,000. She also has mortgage on condo for $97,500 of which $3,200 is payable during the current year.

11. What is Dorothy total long term liabilities?

- $414, 400

($24,000 - $2,700) + ($300,000 - $7,000) + ($9,500 - $3,700) + ($97,500 - $3,200) =

$21,300 + $293,000 + $5,800 + $94,300 = $414,400

12. What is Dorothy total current liabilities?

- $18,100

$2,700 + $7,000 + $3,700 + $3,200 + $1,500 = $18,100

13. What is Dorothy total liabilities?

- $432,500

$414,400 + $18,100 = $432,500

14. What is Dorothy net worth?

- $99,050

Net Worth = Total Assets – Total Liabilites

Total Assets = $750 + $2000 + $34,300 + $5,500 + $15,500 + $350,000 + $1,500 + $1000 + $120,000 + $1,000 = $531,550

$531,550 - $432,500 = $99,050

15. Today is your 21stbirthday and your bank account balance is $25,000. Your account is earning 6.5% interest compounded quarterly. How much will be in the account on your 50th birthday?

- $162,183

PV = $25,000

N = 50-21 = 29*4 = 116

I/Y = 6.5/4 = 1.625%

PMT = 0

FV = ? = $162,182.80 = $162,183

A household has the following statistics related to Balance Sheet and annual Cash Flow:

|

Balance Sheet Items: |

in Dollars |

|

Cash |

2,500 |

|

CD |

12,000 |

|

Savings Account Balance |

3,500 |

|

Credit Card Debt |

9,500 |

|

Current Year Portion of mortgage |

7,800 |

|

Cash Flow Items: | |

|

Salary |

115,000 |

|

Dividend Income |

1,500 |

|

Discretionary Expenses |

8,000 |

|

Nondiscretionary Expenses |

28,975 |

|

Debt Repayment |

8,700 |

|

Retirement Investments |

15,500 |

|

Capital Expenditure |

- |

16. Compute the Nondiscretionary Cost percentage

- $27.87%

Nondiscretionary Cost/Total Income = Nondiscretionary Cost percentage

$28,975/($115,000+$1,500) = .2487 = 24.87%

17. Compute the Emergency Fund Ratio.

- $5.84

Liquid Assets/Monthly Household Expenses = Emergency Fund Ratio

Liquid Assets = Current assets

Liquid Assets = $2,500 + $12,000 + $3,500 = $18,000

Monthly Household Expenses = Nondiscretionary + Discretionary Expenses / 12

Monthly Household Expenses = $28,975 + $8,000 /12 = $36,975/12 =$3,081.25

$18,000/$3,081.25 = 5.84%

18. Compute the Current Ratio.

- $1.04

Current Ratio = Current Assets/Current Liabilities

Current Liabilities = $9,500 + $7,800 = $17,300

Current Ratio = $18,000/$17,300 = 1.04%

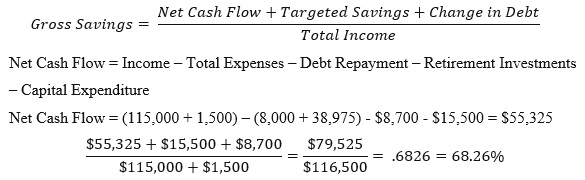

19. Compute the Gross Savings percentage.

- $68.26%

20. Compute the Discretionary Cost percentage

- $6.87%,,

Discretionary Cost / Total Income = Discretionary Cost percentage

$8,000 / ($115,000 + $1,500) = .0687 = 6.87%

Buy FIN4320 Exam 1 Answers Online

Talk to our expert to get the help with FIN4320 Exam 1 to complete your assessment on time and boost your grades now

The main aim/motive of the management assignment help services is to get connect with a greater number of students, and effectively help, and support them in getting completing their assignments the students also get find this a wonderful opportunity where they could effectively learn more about their topics, as the experts also have the best team members with them in which all the members effectively support each other to get complete their diploma assignments. They complete the assessments of the students in an appropriate manner and deliver them back to the students before the due date of the assignment so that the students could timely submit this, and can score higher marks. The experts of the assignment help services at urgenthomework.com are so much skilled, capable, talented, and experienced in their field of programming homework help writing assignments, so, for this, they can effectively write the best economics assignment help services.

Get Online Support for FIN4320 Exam 1 Assignment Help Online

Resources

- 24 x 7 Availability.

- Trained and Certified Experts.

- Deadline Guaranteed.

- Plagiarism Free.

- Privacy Guaranteed.

- Free download.

- Online help for all project.

- Homework Help Services

Testimonials

Urgenthomework helped me with finance homework problems and taught math portion of my course as well. Initially, I used a tutor that taught me math course I felt that as if I was not getting the help I needed. With the help of Urgenthomework, I got precisely where I was weak: Sheryl. Read More