BUSS1030 Accounting, Business and Society

MYOB Assignment

The MYOB assignment provides a platform for students to apply concepts covered in lectures with the knowledge gained from IAN-MYOB. This assessment has an individual component only. The requirements are set out below. A forum has been set up in Ed-Discussions on our Canvas site. Students are welcome to post their questions and assist each other.

REQUIREMENT #1 Personalise the MyConsultingFirm file

Download the files MyConsultingFirm.myo and MyConsultingFirm.box from Canvas Assignments section (BUSS1030 MYOB Assignment Sem 1 2018) and save them to your USB or other personal location. Open MyConsultingFirm.myo with MYOB and accept the Administrator user name (e.g. do not change the default name). No password required. We strongly suggest that you attempt this assignment on campus as the versions that you have downloaded onto your laptops or home computers may not have the functionalities required for this assignment. Honestly, it is not worth the angst doing it anywhere other than on campus.

From the MYOB main menu select Setup and Company Information from the submenu provided by Setup (see Figure A below).

Figure A

Personalise your company with the following personal information. Enter your …

- Full name (preferred name first) to the Company Name

- SID to the AddressThis entry is critical for file identification. Therefore make

sure your SID is entered correctly.

YOU WILL GET ZERO FOR THIS ASSIGNMENT IF YOUR SID IS NOT CORRECTLY ENTERED TO THE COMPANY ADDRESS FIELD.

- University email address to the Email Address

- The other information fields can be left blank.

REQUIREMENT #2 Record journal entries

Enter all required journal entries and adjusting entries for the information provided below. Your entries should result in a correct adjusted balance sheet as at 31 December 2017 and income statement for the six months of operations in 2017.

Use the IAN-MYOB manual for guidance as required. And before you begin entering transactions, see “Notes for using MYOB with this assignment” at the end of this document. These notes will save you time if you look at them now rather than later (or never).

Transactions & Other Information

Martin Russell began his consulting business as a proprietary company on 1 July 2017. He has provided you with the following information for the first 6 months of operations ending 31 December 2017. Martin expects to pay income taxes of 40% on the company’s profits after 12 months of operations.

|

2017 |

Description |

Amount | ||||||||

|

1 July |

Opened business bank account with transfer of personal funds |

$60,000 | ||||||||

|

2 July |

Bank loan approved and received (see Note A) |

$150,000 | ||||||||

|

3 July |

Payment made for rental of office space (see Note B) |

$90,000 | ||||||||

|

4 July |

Office equipment & furniture purchased on credit (see Note C) |

$28,000 | ||||||||

|

15 July |

Invoiced client (Mr.T) for consulting services provided in July |

$4,000 | ||||||||

|

31 July |

Paid wages to associates for work performed in July |

$3,500 | ||||||||

|

2 Aug |

Received payment from client (Mr.T) |

$4,000 | ||||||||

|

23 Aug |

Received payment from client (Ms.TT) for August services |

$2,000 | ||||||||

|

31 Aug |

Paid wages to associates for work performed in August |

$3,500 | ||||||||

|

30 Sept |

Consulting services provided and payment received |

$270,000 | ||||||||

|

30 Sept |

Paid wages to associates for work performed in September |

$3,500 | ||||||||

|

1 Oct |

Payment made for coffee room supplies (e.g. coffee, sugar, etc) |

$1,000 | ||||||||

|

31 Oct |

Consulting services provided. Payment not yet received |

$120,000 | ||||||||

|

31 Oct |

Paid wages to associates for work performed in October |

$3,500 | ||||||||

|

30 Nov |

Wages paid to associates for work performed in November |

$3,500 | ||||||||

|

15 Dec |

Office stationery purchase (see Note D) |

$10,000 | ||||||||

|

30 Dec |

Payment for electricity (see Note E) |

$6,000 | ||||||||

|

31 Dec |

{"Overseas financing revenue"} (see Note F) |

$130,000 | ||||||||

|

Note A |

The loan contract calls for repayment of $25,000 per year beginning in January 2018. | |||||||||

|

Note B |

Martin signed a lease agreement for office space for 30 months at $3,000 per month with July 2017 being month #1. | |||||||||

|

Note C |

The office equipment and furniture will be completely replaced in four years. | |||||||||

|

Note D |

| |||||||||

|

Note E |

Payment is for the months of July to November 2017. The December 2017 electricity bill for $1,200 remains unpaid. | |||||||||

|

Note F |

This {"revenue"} represents money received from an overseas client who wanted to invest in the business. The agreement signed with the investor calls for repayment of the entire amount in 5 years. | |||||||||

|

Note G |

Received invoice on 2 January 2018 for legal advice provided to the company in November. Your company’s unique “legal advice” amount is the last five digits of your SID. E.g. SID 200238754 would record an amount of $38,754 for this transaction. | |||||||||

|

Note H |

December wages of $3,500 and a $2,000 Christmas bonus paid on 2 January 2018. | |||||||||

REQUIREMENT #3 Produce Reports

Generate an Excel copy of each of the reports below by using the MYOB Send To procedure.

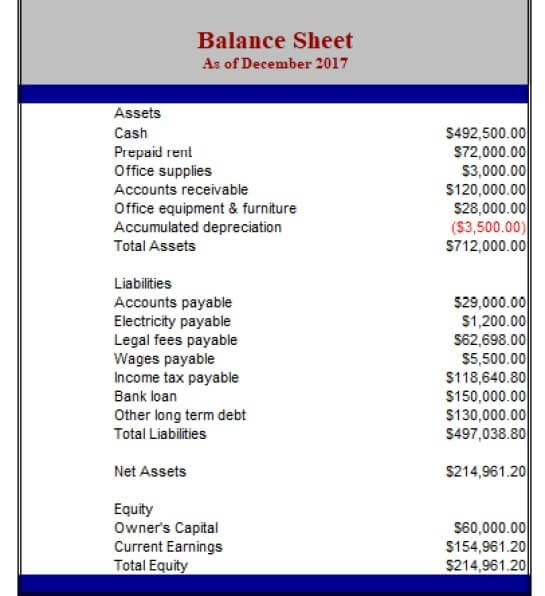

- Balance sheet as at 31 December 2017 (MYOB Standard Balance Sheet)

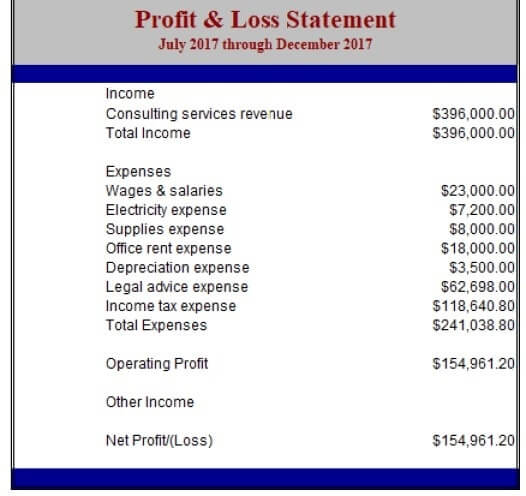

- Income statement for the 6 months ended 31 Dec 2017 (MYOB Profit & Loss [Accrual])

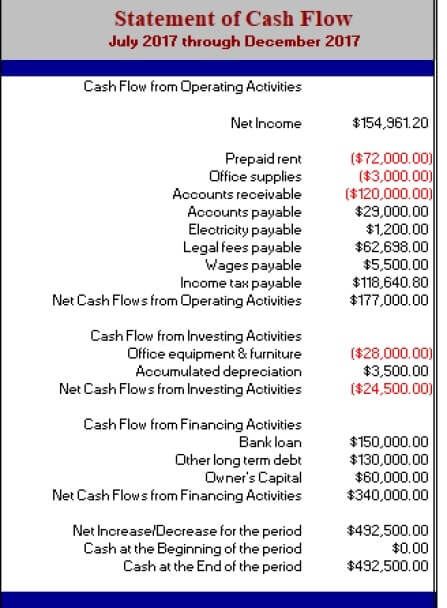

- Statement of cash flow for the 6 months ended 31 Dec 2017 (see Ch.10 MYOB manual)

- General journal showing all journal entries (see Transaction Journals)

- General ledger for the 6 months ended 31 Dec 2017 (MYOB General Ledger [Detail])

Your MYOB reports must display $’s as the currency. Chinese yuan, British pounds and any other currency WILL RESULT IN ZERO MARKS. If you can’t work out how to change your computer to $’s you’ll need to produce your reports elsewhere (e.g. at uni).

It is critical that you do not use Excel to make changes to your MYOB generated Excel reports. Alterations to your files will disable electronic assessment and cause you to receive a zero mark for the altered, non-assessable report.

You may quite rightly think that you should “fix” your MYOB Excel reports. E.g. formatting or title changes. DON’T DO IT! See above.

Accept the MYOB default file names (e.g. PL1.xlsx) provided for each of the five reports. There’s no need to provide more descriptive file names.

- xlsx (Balance sheet) (5) GENJRLD1.xlsx (General ledger detail)

- xlsx (Income statement) (6) MyConsultingFirm.myo (MYOB file)

- xlsx (Cash flow statement) (7) MyConsultingFirm.box (MYOB file)

- xlsx (General journal)

Do not password protect any of your files. We need to open them for marking.

Submit the wrong file? No problem. Submit again. The last file submitted will be marked.

While you must submit the final versions of your MYOB files (e.g. MyConsultingFirm.myo & .box) they will not be marked. Failure to do so will result in a penalty of 10 points (out of 100 available).

If we can’t open your Excel files with PC Excel you will receive zero. Therefore, check that the upload of your files has worked. Follow these steps to check the upload of your hard work.

- After selecting Submit you will receive the Review Submission History

- Click the Download button to access the file just submitted to Canvas.

- Attempt to open the downloaded files using PC Excel. You must be able to open the downloaded copies of your submitted files without error for them to be marked.

REQUIREMENT #5 Preparation for Tutorial Discussion

Carefully examine your MYOB Excel balance sheet, income statement and cash flow statement. Prepare a list of good features and not so good components. Be prepared to discuss your list in your week 12 tutorial.

The week 12 tutorial will also include discussion of the advantages and disadvantages of using MYOB for preparing Martin Russell’s financial statements.

Notes for using MYOB with this assignment

GST and interest: Can be totally ignored.

Chart of accounts: The chart of accounts provided is “pretty good”. However, there are a couple of accounts that you probably shouldn’t use and you may want to create an account or two. However, donot add or delete accounts or change the existing account names or numbers. Do the best accounting possible with the accounts provided. Penalty of 1 mark (out of 5 marks available for this assessment) for each account addition, deletion or change that you make.

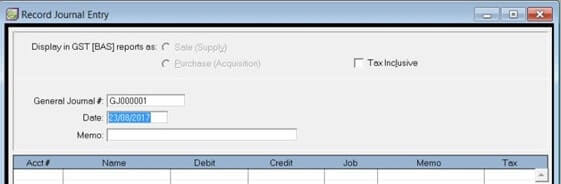

Fields you can ignore: When recording journal entries there are several fields provided in MYOB that you may safely ignore. E.g. GST, Job and Tax. See circled areas in Figure below.

Ignore linked account warning: MYOB will alert you that Accounts Receivable and Accounts Payable are linked accounts. Ignore this warning.

Cash on hand account: Don’t use this account. All cash receipts and payments should be made using the cash account (i.e. use #1-1100, not #1-1180).

File Verification, Session report and File Backup warnings: MYOB will suggest that you verify your data and backup your file at various times. Your choice. Same with the Session Report.

Entering dates: Getting the proper format for dates is a pain in MYOB. However, you are provided with a handy little calendar for input if you press the space bar while in the date field.

Cursor stuck? E.g. can’t move to next field. Try the tab key. You’d thinking clicking would work but MYOB prefers the old-fashioned method sometimes (e.g. press tab).

Tired of making the same entry over and over: Use MYOB’s “Save as Recurring” option button at bottom right of Record Journal Entry screen.

Saving the MYOB files: The MyConsultingFirm.box and .myo files do not have to be saved as you enter transactions et al. E.g. MYOB is a database that updates these files automatically.

Exporting reports to Excel: Under Report Customisation your Report Level should be Level 4. This is the default level. Don’t change it.

Balance Sheet Statement

Cash Flow Statement

Profit and Loss Statement

Marking Guide

(adapted from hplengr.engr.wisc.edu/Rubric_Presentation.do accessed on 27th April 2017)

|

Category |

Scoring Criteria |

Points |

Score |

|

Content (100 points) |

General Journal accuracy and completeness |

5 | |

|

Balance sheet accuracy and completeness |

40 | ||

|

Income statement accuracy and completeness |

45 | ||

|

Cash flow statement accuracy and completeness |

6 | ||

|

General Ledger accuracy and completeness |

4 | ||

|

Score |

Total Points |

100 |